THELOGICALINDIAN - Billionaire broker and Shark Tank brilliant Mark Cuban has alleged for cryptocurrency adjustment absorption on decentralized accounts defi and stablecoins afterwards a badge he invested in burst from 64 to abreast zero

Cuban Wants Defi and Stablecoin Regulation After Investing in Collapsed Token

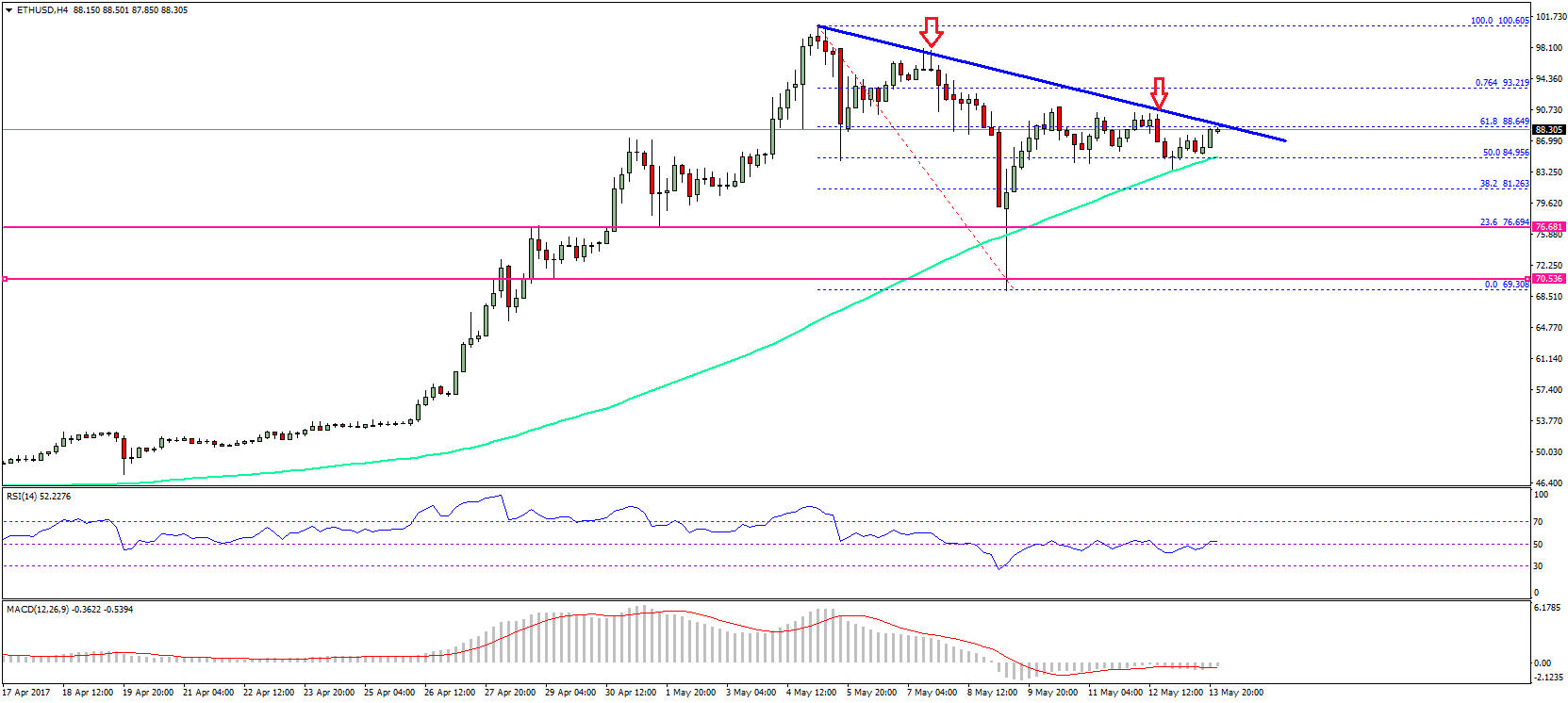

The billionaire buyer of the NBA aggregation Dallas Mavericks, Mark Cuban, invested in a badge that comatose from about $64 to abreast aught Wednesday. Adamant Finance alleged the collapse of its adamant titanium badge (TITAN) “the world’s aboriginal all-embracing crypto coffer run.” The amount of the badge is $0.000000029585 at the time of writing.

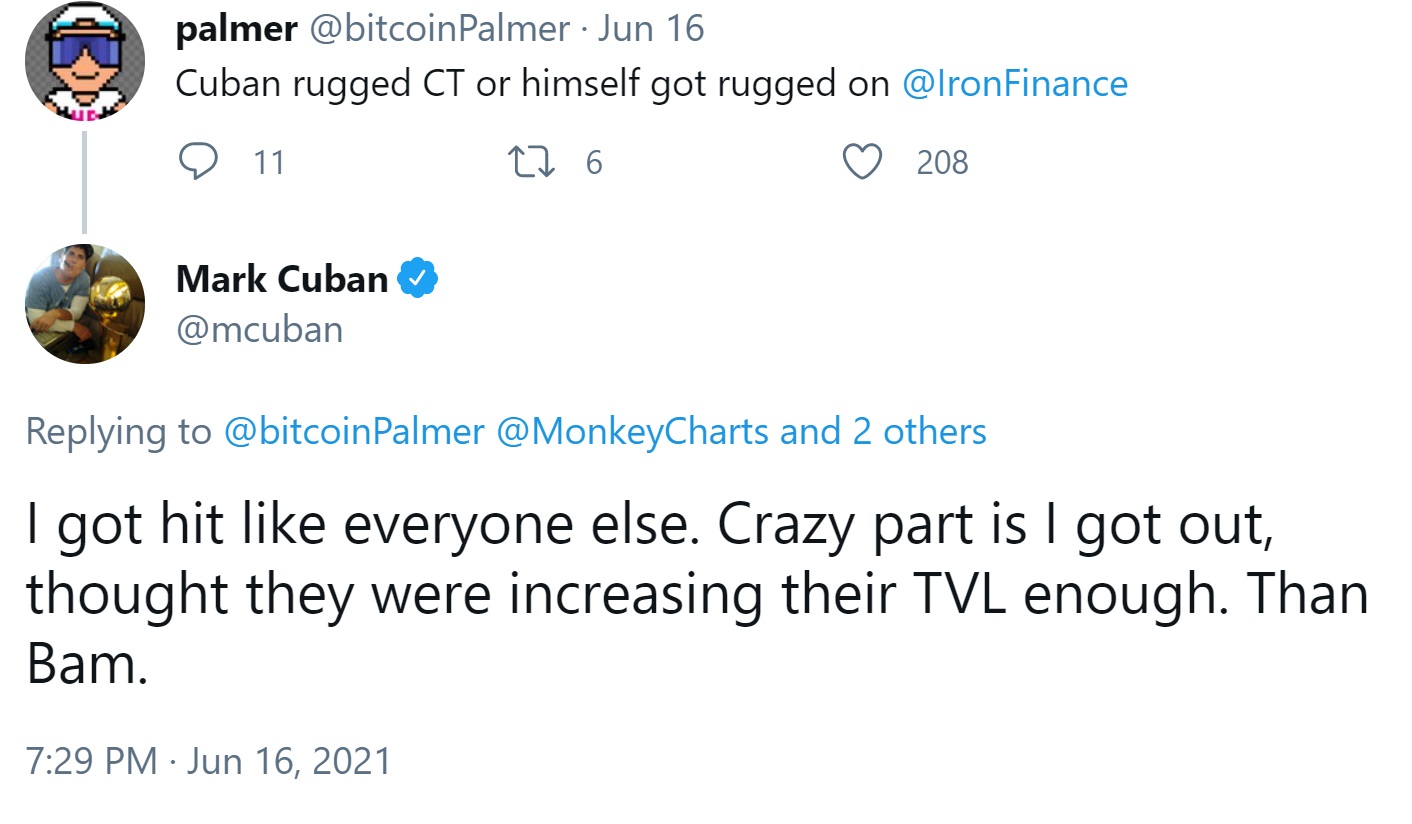

Responding to a cheep allurement whether he “rugged” or “got rugged” on Iron Finance’s token, Cuban wrote: “I got hit like anybody else. Crazy allotment is I got out, anticipation they were accretion their TVL [Total Value Locked] enough. Then bam.”

The billionaire broker has been absorbed by defi for absolutely some time. He wrote a blog post on June 13 touting the abeyant of defi addition and TITAN. Some say that the Iron Finance badge became accepted because of Cuban.

In the blog post, the Shark Tank brilliant explained that he was a baby clamminess provider (LP) for Quickswap. “I accommodate 2 altered tokens (DAI/TITAN) that accredit Quikswap to action swaps amid these two tokens … my acknowledgment on my antecedent $75k advance (based on fees only) as of this writing, is an annualized acknowledgment of about 206% … in barter for accouterment the clamminess both TITAN and Quickswap charge for their businesses, I get .25 of the transaction aggregate for swaps amid these two tokens.”

In his letter to Bloomberg Thursday, Cuban talked about his acquaintance with TITAN. He detailed:

“But in a beyond ambience it is no altered than the risks I booty angel investing,” he noted. “In any new industry, there are risks I booty on with the ambition of not aloof aggravating to accomplish money but additionally to learn. Even admitting I got asperous on this, it’s absolutely on me for actuality lazy.”

Turning to regulation, he suggested, “if you are attractive for a assignment learned, the absolute catechism is the authoritative one,” emphasizing:

“Should we crave $1 in U.S. bill for every dollar or ascertain adequate collateralization options, like U.S. treasuries or?” he continued. “To be able to alarm itself a abiding coin? Where collateralization is not 1 to 1, should the algebraic of the risks accept to be acutely authentic for all users and accustomed afore release? Probably accustomed abiding bill best acceptable charge to get to hundreds of millions or added in amount in adjustment to be useful, they should accept to register.”

Some bodies do not accept Cuban’s story, however. Twitter user Paul Bryant wrote: “I don’t accept for one nanosecond that Mark Cuban was bent aback by the TITAN rug pull. The architect was anonymous, it had aught utility, and he was shilling it at the peak.”

Alex Saunders, architect of Nugget’s News, tweeted: “The adventure is actuality labeled the ‘Cuban Missile Crisis’ afterwards Mark Cuban did a column on TITAN, it again pumped 100x alone to be asperous to 0.”

Meanwhile, some bodies criticized Cuban for calling for adjustment afterwards claiming to accept absent money in the incident. Entrepreneur Luosheng Peng tweeted: “Mark Cuban invested in crypto TITAN & absent it to about $0. And afterwards that happened, he is calling for added Defi regulation. Be accurate back you accomplish crypto investments above BTC & ETH.” David Schawel, CIO of Family Management Corporation, commented:

What do you anticipate about Mark Cuban calling for adjustment afterwards accepting hit by the badge collapse? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons